Investors See Taxes as Biggest Drag on Investment Climate

Tuesday, September 22nd, 2015

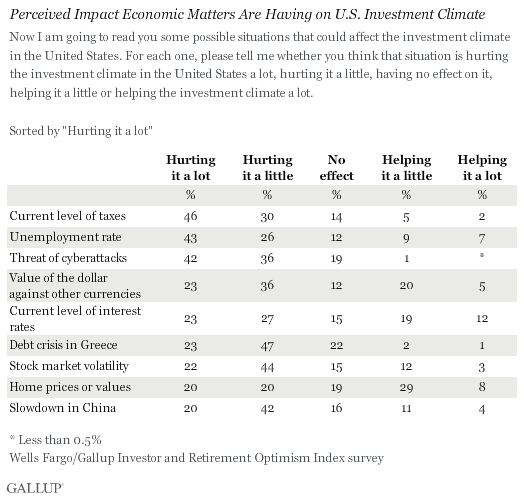

U.S. investors see the current level of taxes as having the most negative effect on the U.S. investment climate out of nine economic factors they were asked about in the third quarter. Forty-six percent say taxes are hurting the investment climate a lot. Unemployment and the threat of cyberattacks closely follow taxes, while investors see the value of the dollar, interest rates and home prices as far less harmful.

Other matters of less concern to investors include the Greek debt crisis, stock market volatility and a slowdown in China. Roughly one in five investors say each of these hurts the investment climate a lot.

The Wells Fargo/Gallup Investor and Retirement Optimism Index survey was conducted Aug. 7-16, prior to the sharp decline in U.S. stocks starting on Aug. 20 that was triggered by global concern over China's weakening economy. As a result, investors' perceptions of how China's economic slowdown is affecting the U.S. investment climate could be more negative if they were measured today. The same could be said for investors' concerns about stock market volatility. Still, the poll was conducted less than a month after China's already-volatile stock market plunged more than 8% in late July, making major headlines and raising global concerns about weakened consumer demand in that country.

Similarly, less than a quarter of investors in August believed the Greek debt crisis was hurting the U.S. investment climate a lot, even after the matter triggered a major sell-off in the U.S. equities market in late June, likely contributing to a decline in U.S. consumers' economic confidence.

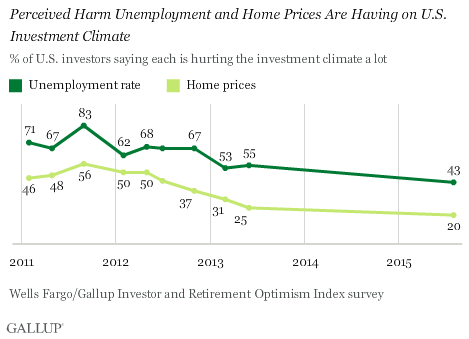

One piece of good news from the poll is that even though unemployment registers among the highest levels of investor concern, the percentage saying unemployment is hurting the investment climate a lot remains well below the levels seen from 2011 to 2013. Concern about housing negatively affecting the markets also fell sharply at the same time.

Also, although none of the nine economic issues measured is seen as more helpful than harmful to the investment climate right now, home values and interest rates come closest. The net-positive perception about home prices is currently -3, based on a combined 37% of investors saying home prices are helping the investment climate a lot or a little and 40% saying home prices are hurting the investment climate a lot or a little. The net perception of interest rates is -19, with a combined 31% saying these are helping the investment climate and 50% hurting it.

Bottom Line

As of mid-August, U.S. investors were far more concerned about how U.S. taxes and unemployment, rather than economic troubles in Greece and China, were affecting the U.S. markets. While investors' concerns about China have likely increased since that time, their low concerns about Greece less than two months after that country's economic problems spilled over into U.S. markets suggest such global issues have a short lifespan on investors' radar. Meanwhile, nothing has occurred that should have rattled investors' improved perceptions of unemployment and home values. And continued stability in both of these core aspects of the domestic economy should help investors remain calm through any additional globally induced market lurches.