U.S. Investors Say Low Interest Rates Do More Good Than Harm

Wednesday, September 16th, 2015

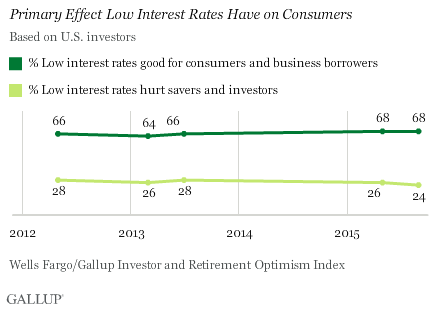

As Wall Street and others anxiously await the Federal Reserve Board's decision about raising interest rates at its quarterly meeting on Thursday, more U.S. investors continue to say today's low interest rates do good for consumers by helping borrowers (68%) than say low rates do harm by hurting savers (24%).

Investors' views on this issue have been rock steady since the initial measure in 2012.

Further, twice as many investors say today's low rates are helping their own finances (29%) than say the low rates are hurting them (15%). Low rates especially aid nonretired investors, with 34% saying the rates are helping them financially, whereas 12% say they are hurting them. Retired investors, on the other hand, have the opposite view, with 15% saying the low rates are helping them and 28% say they are hurting them. The majority of both groups, however, say low rates aren't affecting them.

These findings are from the third-quarter Wells Fargo/Gallup Investor and Retirement Optimism Index survey, conducted Aug. 7-16. Investors are defined for this survey as U.S. adults who have at least $10,000 invested in stocks, bonds or mutual funds, a criterion met by 44% of U.S. adults in the current survey.

Six in 10 Investors Recently Capitalized on Low Interest Rates

Despite the relatively low 29% of all investors who say that low interest rates are helping their finances, many more investors report having taken advantage of low interest rates to refinance or take out various types of new loans. Overall, 58% of investors say they have taken advantage of low rates in the past two years by doing one or more of the following: purchasing a car (30%), refinancing a mortgage or home loan (17%), purchasing a home (16%), taking out a student loan (9%) or taking out another type of loan (10%).

Not all of these investors may feel the low rate they received on their transaction has "helped" them financially, particularly when it involves taking on a major new expense such as a car payment, mortgage or college debt. But clearly they are better off than they would have been if rates were higher.

Investors Won't Be Shocked by Rate Hike

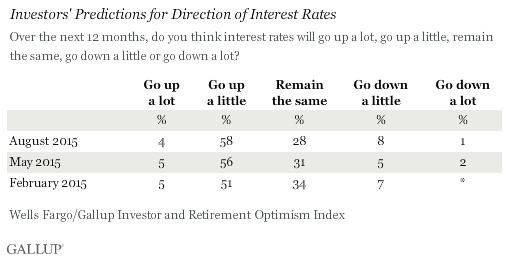

Despite mounting signs that the Federal Reserve wants to raise rates as soon as is safely possible, investors are no more likely today than in the prior quarter to believe interest rates will rise in the next year. About six in 10 investors predict interest rates will go up a little over the next 12 months, similar to 56% saying this in May. An additional 4% now -- versus 5% in May -- think rates will go up a lot.

The trend on this has been remarkably flat all year, possibly indicating that investors' views may be based more on a generalized belief that rates can't stay this low much longer than on whatever they are reading in the news about the Federal Reserve's specific intentions about raising rates this quarter. On the other hand, Federal Reserve Chair Janet Yellen has signaled for much of the year that she wants to raise rates, so perhaps that message has gotten through.

Relatively few investors -- 17% -- say they pay very close attention to U.S. interest rates, but among those who do, more than three-quarters expect rates to rise within the year, either by a little (67%) or a lot (10%).

Bottom Line

Any increase in the Federal Reserve's federal funds interest rate will be a big deal on Wall Street, at least initially. Whether the rate hike puts enough of a damper on consumer spending to slow the economy is an open question that even the Fed can't answer, and is partly why it has been so cautious about making the move. Investors have anticipated a hike in interest rates for some time. This suggests investors wouldn't be shocked if it happens Thursday, possibly limiting the impact it would have on their behavior.