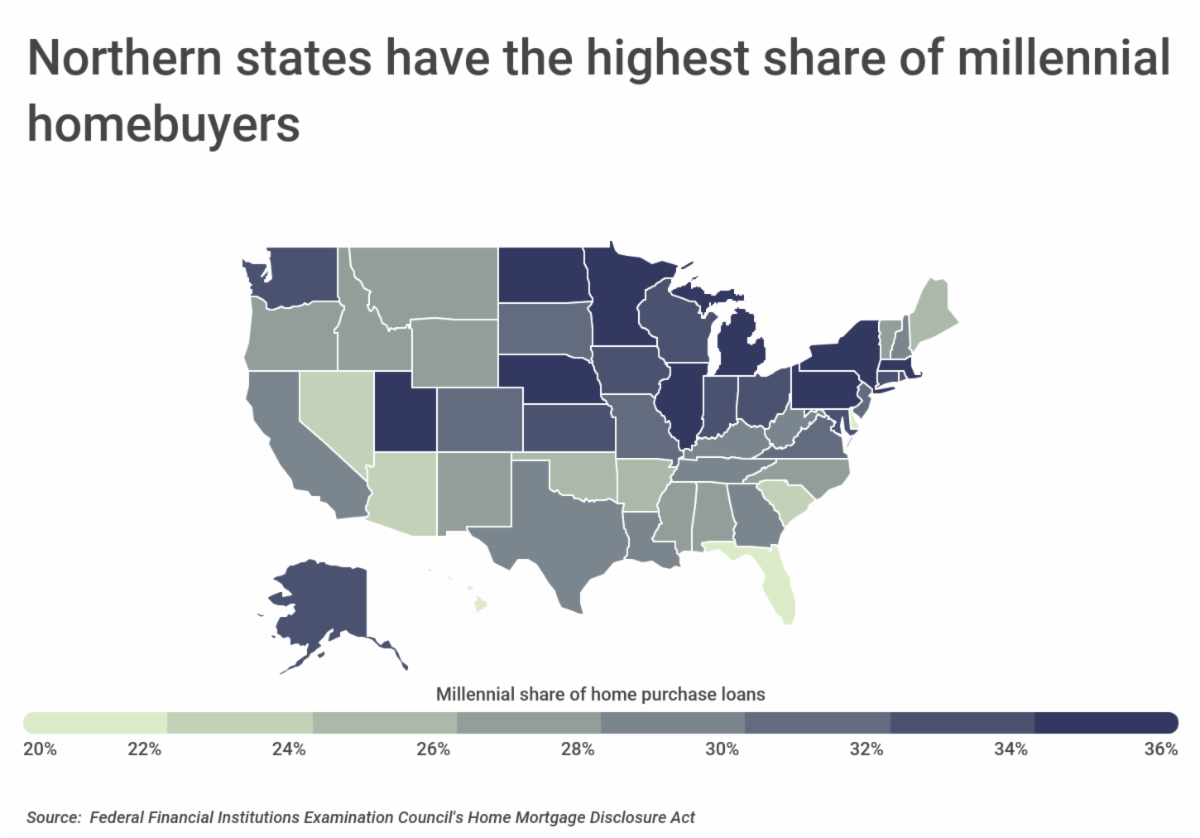

The Millennial Share of Home Purchase Loans in Georgia Was 28.6%

Monday, February 28th, 2022

Historically low interest rates, higher family savings, and new-found work-from-home opportunities driven by pandemic-related restrictions have combined to stimulate housing demand that raised the median price of existing single-family homes by 39% from 2018 to 2021. This boom impacted all ages of homebuyers, and was particularly pronounced on millennials, who are now in their prime homebuying years.

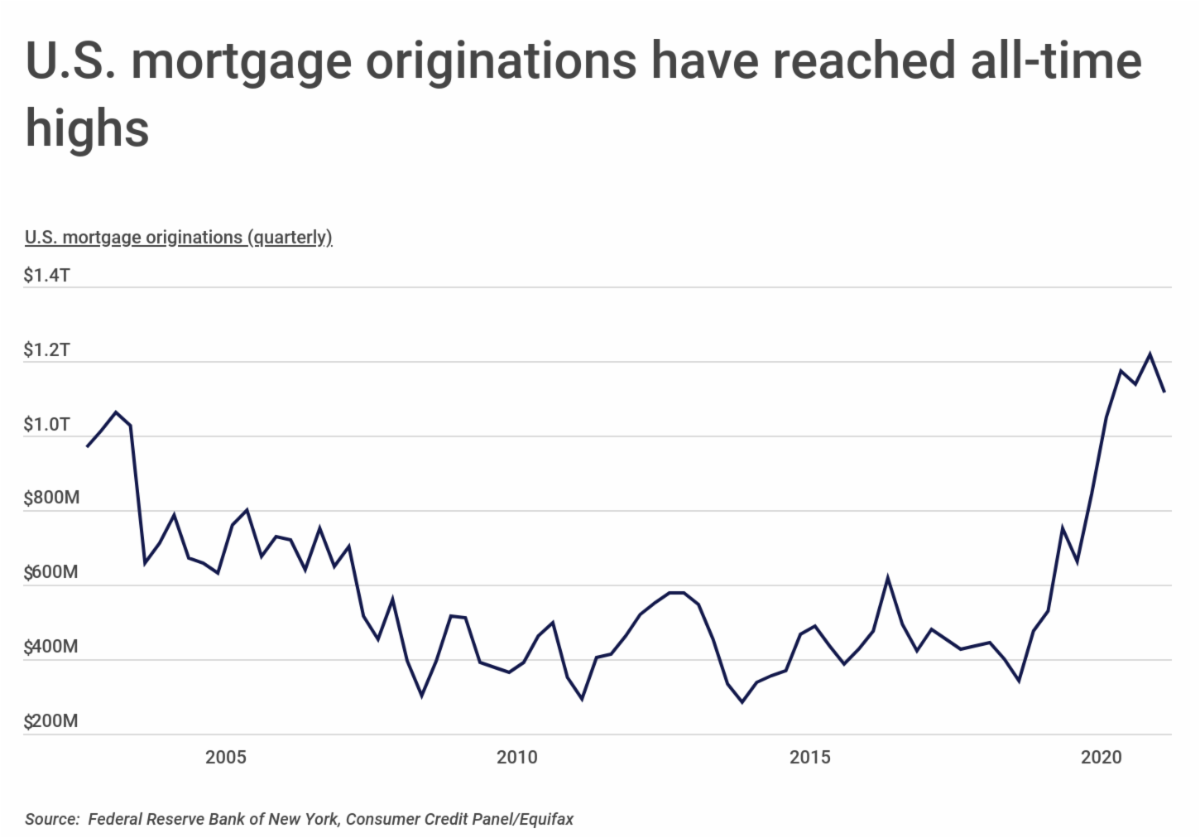

The total number of U.S. mortgage originations each year has generally fallen from just over a trillion dollars per quarter in 2003 to a relatively steady average of $430 billion between 2008 and 2019. However, after a spike at the end of 2019, mortgage originations have again peaked at well over a trillion dollars per quarter at the end of 2020 and into 2021, reflecting a surge in home sales amid the COVID-19 pandemic.

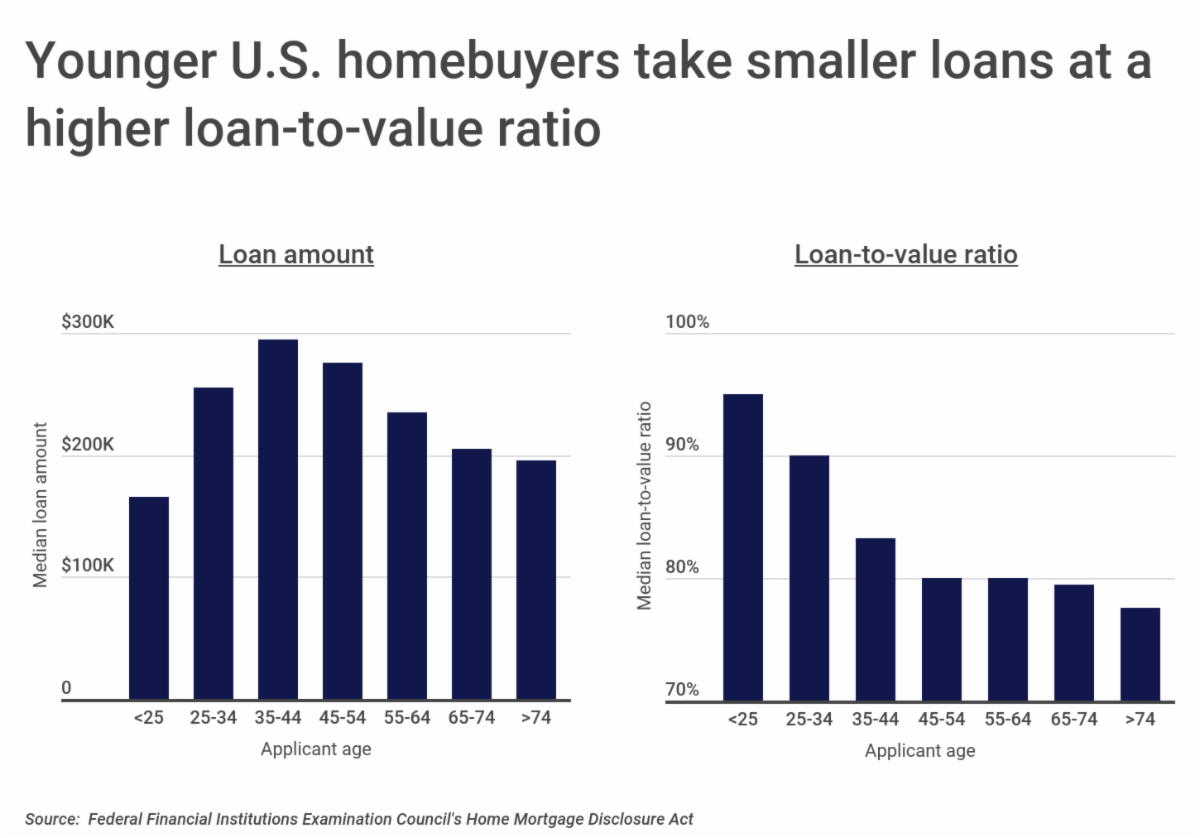

Since 2014, millennials have comprised the largest share of homebuyers in the U.S. Today, the generation makes up about 37% of all homebuyers, according to a recent National Association of Realtors report, with Gen Xers comprising the next biggest group at 24%. A survey of millennial homebuyers in late 2020 revealed that over half had accelerated their planned home purchases in response to the pandemic. The drive for homeownership has been strong for millennials, despite the substantial financial pressures they faced. For example, most millennials had no existing home equity to apply to their mortgage loans, as a majority of buyers under 40 were first-time homebuyers. Additionally, even though millennial mortgage applicants have experienced strong income growth in recent years, these salary increases often came from high-tech jobs located in larger metro areas with higher home prices, according to CoreLogic. One survey found that most millennial homebuyers ended up buying homes that needed more renovations than expected, and over a third exceeded their anticipated budget. Undeterred, millennial homebuyers tended to take out smaller loans, and usually with higher loan-to-value ratios, based on data from the Home Mortgage Disclosure Act. In 2020, the average home loan value for applicants between 25- and 34-years old, an age range which represents the majority of millennials, was $255,000. This compares to an average home loan value of $275,000 for 45- to 54-year old applicants, which represents most Gen Xers. Further, most millennials tend to apply for home loans with a higher median loan-to-value ratio (90%) than most Gen Xers (80%).

|